What is mortgage refinancing?

Mortgage refinancing means that you pay off your current mortgage with a new mortgage. This is usually done to either lower the rate on your current loan with a new loan with a lower rate or to take equity out of a property with a loan balance that is a higher balance than the loan you currently have.

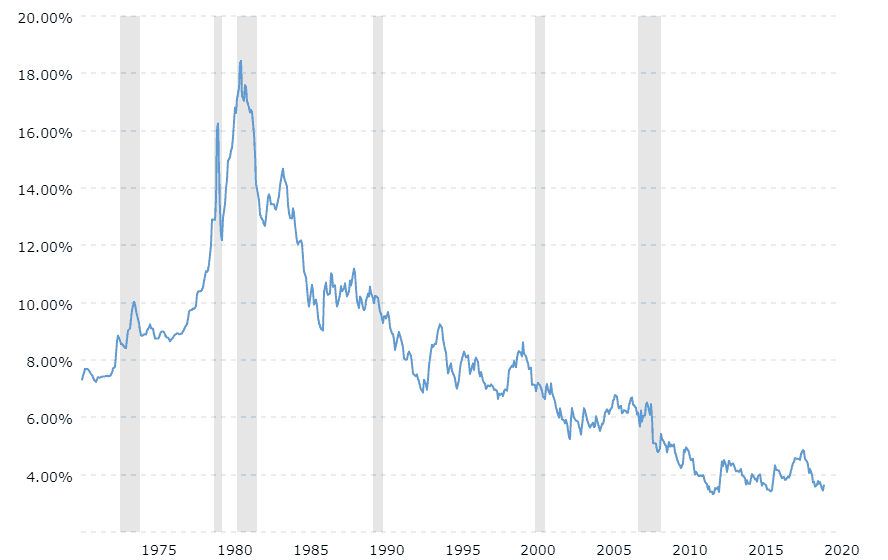

Drop in interest rates

Rate as of March 2020 is 3.65%

Source: Macrotrends

30 Year Fixed Mortgage rate is dropping. When mortgage rates fall since the time you took the loan refinancing. It can allow you to save money on the lifetime interest of the loan. A 30-year fixed mortgage when interest rates were at 5%, and now they’re down to 3.5%. Based on a $640,000 loan, that interest rate drop alone would have to a $562 reduction in your monthly interest payment.

A general rule of thumb is that the new mortgage loan should have an interest rate that is at least 1% less than your present mortgage before you consider refinancing. You are still required to calculate the actual numbers. In addition, having longer-term mortgages allow savings to break even much faster when considering the lost interest deduction because the interest savings is greater. It also depends on your improved credit situation and you can be eligible for a much affordable rate of interest.

Shorter period to pay off the loan

When you refinance from a 30-year mortgage into a 15-year mortgage, you can pay off the loan faster. This also allows you to pay less interest over the life of the loan. There are pros and cons to a 15-year mortgage. One downside is that the monthly repayments usually go up. A shorter mortgage period does have some interest-saving benefits.

Before you refinance into a shorter mortgage term, you have first to calculate your personal finances carefully. One key thing to consider is your job security. Whether your career is stable and if you are expecting your income to increase, then refinancing to a shorter mortgage would be a good decision. Consider the scenario that there is a company restructuring and you lose your job, do you have enough savings before you find another career.

Tap into equity.

When you refinance to borrow more than you owe on your current loan, the lender gives you a check for the difference. This is called a cash-out refinance. People often get a cash-out to refinance and a lower interest rate with mortgage loans at the same time.

Some of you might be using refinance loans to pay off higher interest loans, children education fee, renovation fee, car, or even starting a business.

Lower monthly mortgage payment by lengthening the loan term

If you are thinking to pay less monthly on the mortgage, you can refinance into a loan with a lower interest rate. Another way to reduce the monthly payment is to extend the mortgage period — say, from 10 years to 30. The drawback to extend the mortgage term is that you end up paying more interest in the long run. Ask yourself if you are getting income for the additional 20 years.

You have various reasons to lower monthly payment, like cash flow problems, additional monthly instalments (car loans, insurance) that require you to that a lower mortgage payment.

Improved your credit score

You may received a loan with a higher interest when you are in a dificult financial situation that result in a poor credit score. There are other reasons that affect your credit score, lost your job previously, have a medical condition causes you to be in debt, or even filed for bankruptcy. As soon as you’ve improved your credit score, you likely can refinance those loans at a much lower rate. This will translate into savings.

How much is the refinance closign cost?

Your Closing Disclosure tells you exactly what you need to pay at closing. Here are a few of the closing costs you might see when you refinance:

Application fee: Some lenders charge an application fee due when you apply for your refinance. You must pay your application fee even if the lender rejects your refinance request.

Appraisal fee: Most lenders require appraisals before refinancing. Most appraisers charge $300 – $500 for their services.

Attorney fees: In some states, an attorney must review and file paperwork for your loan. Attorney fees can vary widely by state.

Title search and insurance: Your lender may require another title search when you refinance your loan.

Expect to pay 2% – 3% of your loan balance in closing costs. You may be able to roll your closing costs into your loan balance, depending on your lender’s requirements.

The prospect of a significantly lower interest rate on your loan can be tempting for any homeowner. But before proceeding with a refi, you really need to know what it’ll cost. Often what seems like a great deal loses its luster when you see the fees.

This is why it’s important to compare the good faith estimates from various lenders. These documents include the interest rate as well as a breakout of the projected expenses to close the loan.

One of the biggest outlays is the lender’s “origination fee.” But you’ll also face a range of other charges, like costs for an updated appraisal, title search fees, and the premium for title insurance. In total, all those costs can add up to as much as 5% of the loan’s value.

[srzmort id=1]